Why Multifamily Solvency Will Demand Transparency

Charlie Kokernak

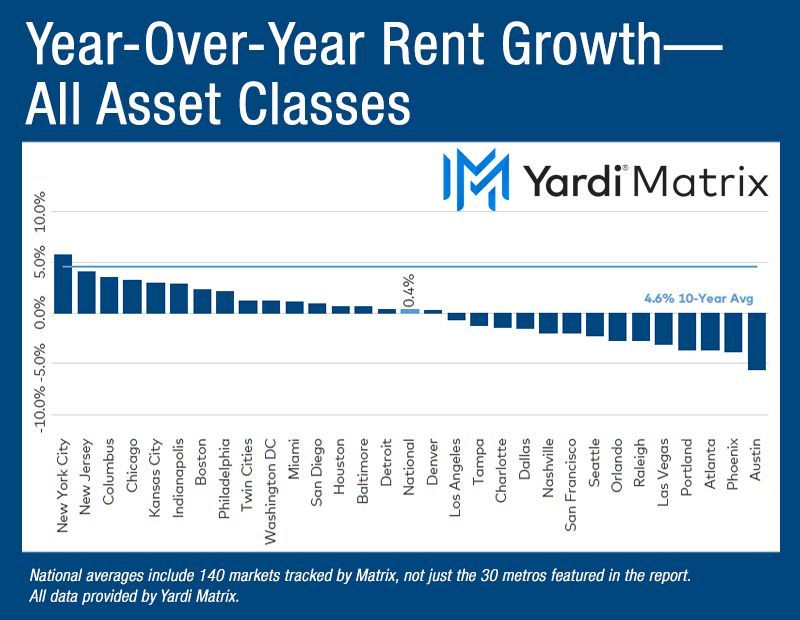

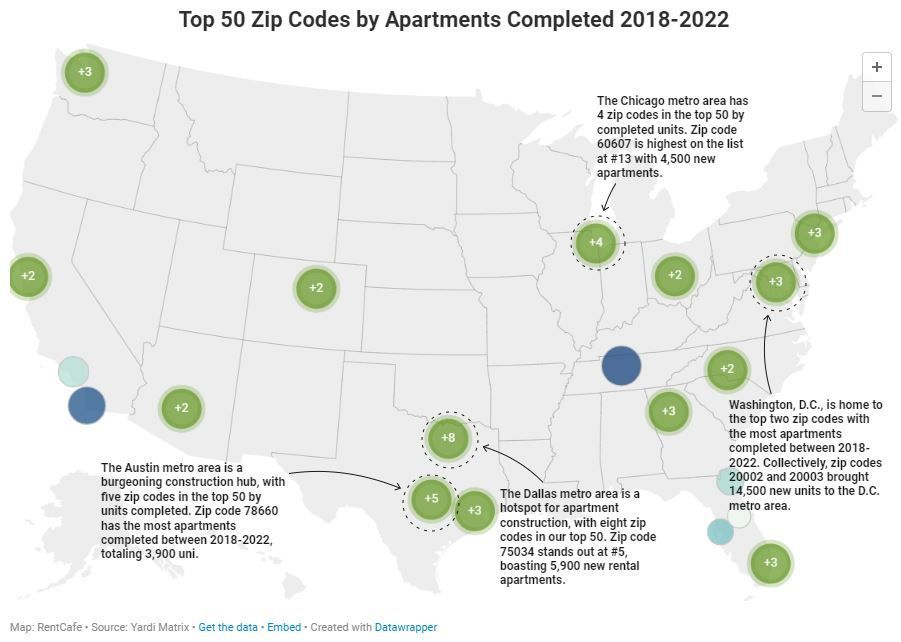

Almost all financing requests in the current cycle involve a sobering moment of transparency with borrowers as to where the lending world is today. If you are an apartment investor or developer delivering a new build or value-add project, or an investor who purchased into high leverage tied to non-materializing future performance expectations, you’re probably already feeling or at least preparing for the sting from the higher price of capital, volatile rates, decreased leasing velocity, cooling rents, or rising materials, labor, and insurance costs. For many, it will likely be a story blending some, if not all, of the above.

The pullback of many traditional banks continues to compound anxieties of what’s next. Debt funds, while remaining opportunistic and accessible in the current cycle will still be seeking to exit existing short-term bridge and construction financing loans and are underwriting any new financings to stricter standards. Credit unions also provide an option, but one that typically have recourse requirements and do not fit all entity structures. So, what options does that leave us?

This is where multifamily properties will enjoy a unique benefit of the asset class, as Agency lenders remain active in the market alongside life company lenders. The key for successfully executing a financing strategy in this climate will ultimately rest on deliverability as much as plausibility, and both sources are known for their dependability. These lenders take a longer view and are keenly aware of current market dynamics. Their funding isn’t tied to the ebb-and-flow of depositors or investor covenants and tend to embrace a long view on returns. They are also now providing creative options to navigate new loans to qualifying borrowers.

The following are some of the ways we are getting in front of 2024 and ensuring capital continues to flow from all sources.

Market timing

It used to be standard to start a financing review 60 to 90 days from maturity. That confidence was for an era of historically low rates and a seemingly endless pool of capital sources. Now we are recommending at least 180 days or more to maximize options and prepare for all eventualities. While liquidity remains accessible, debt service coverage at these higher rates will force many sponsors to revisit their proformas to determine how to best right-size their loan. This will require a holistic approach to review both resources on hand and capital available from the market.

Holistic portfolio review

Identifying lending options should include a full analysis of a sponsor’s existing portfolio, maturing loan structures and timing, operational cash flows, and local market fundamentals. It may be that some properties currently performing with lower rate financing in place could be refinanced to free up proceeds, cross collateralized, or have second position loans added. If the long-term goal is to return a full portfolio to profitability and hold on to a property for its upside potential in future market conditions, it may make sense to do this. Only a deep analysis will tell, and this is what Gantry is performing daily for our clients.

Creative capital

Sponsors unable to currently meet an approximately 1.25 debt service coverage from existing operations at the new higher rate threshold will need to choose a direction moving forward: sell or creatively recapitalize. Depending on the potential of a property, refinancing existing debt could require committing more direct equity, taking on mezzanine debt, or bringing in a partner. The latter of which could dilute potential upside but also preserve existing equity and ultimately save the asset.

Agencies

The government agencies remain a viable option for most if not all currently performing multifamily properties, and they are especially generous with properties that meet affordability standards in their local markets. They are approaching the higher rate climate by incorporating interest only periods for a portion or entirety of the loan, exploring rate locks during lease up, or even providing variable rate financing at attractive rates, an option worth considering if you believe we have reached the peak of Fed Rate increases.

Participation loans

Life companies and other lenders have introduced loans that act essentially as mezzanine debt or a cash-in partnership, wherein they offer a reduced interest rate to participate in the profits generated from operational cash flow and potential gains upon the sale. These loans are worth exploring for a borrower who wants best of class support and participation from their capital partner, a fixed rate, and certainty of execution.

This past year has been a cycle shift of epic proportions. To survive and thrive in 2024, I encourage borrowers to be creative, diligent, and prepared. We may be in a significantly higher rate era, but we are working through the correction. The key is to keep your options open, analyzed, and accessible.

Charlie Kokernak is director, Gantry.

The post Why Multifamily Solvency Will Demand Transparency appeared first on Multi-Housing News.

Contact Information

7150 East Camelback Road, Scottsdale, AZ 85251

Email Address: info@fourpalmscapital.com

Phone Number: 484-767-7331

Browse Our Website

About Our Company

All Rights Reserved | Four Palms Capital