National Multifamily Report – October 2023

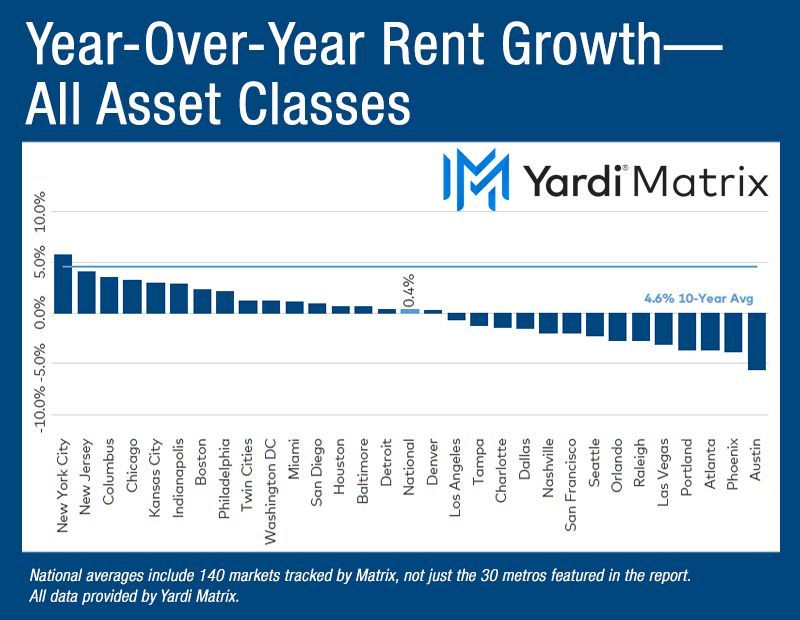

Year-over-year multifamily rent growth, all asset classes. Chart courtesy of Yardi Matrix

The final quarter of 2023 began on a somewhat gloomy note for the U.S. multifamily fundamentals, with the average asking rent down $3 to $1,718 in October, a 0.4 percent decrease year-over-year, according to Yardi Matrix ’s latest monthly multifamily report. In addition, the national occupancy rate marked the first decline in four months, falling to 94.9 percent. Meanwhile, the SFR sector remained firm, with occupancy at 95.9 percent as of September, and rent growth at 1.0 percent year-over-year, to $2,121 in October, a $2 drop from the previous month.

Multifamily demand and absorption were still at fairly normal levels—during the first three quarters of 2023, more than 250,000 units were absorbed nationally, which aligns with the 300,000-unit annual average between 2017 and 2020.

Northeast and Midwest metros continued to lead rent growth: New York City (5.8 percent year-over-year), New Jersey (4.1 percent), Columbus (3.5 percent), Chicago (3.2 percent) and Kansas City (3.0 percent). Yet, growth in these metros was offset by slight declines in metros in the Sun Belt and West. Overall, 14 of Yardi Matrix’s top 30 markets were down year-over-year. Occupancy rates declined or remained flat on a year-over-year basis as of September in all but four markets: Chicago (up 0.5 percent), Denver (0.3 percent), New York (0.1 percent) and Seattle (0.1 percent).

On a monthly basis, the U.S. multifamily asking rents declined 0.2 percent in October, unchanged in the Renter-by-Necessity segment and down 0.4 percent in the Lifestyle segment. More so, rents declined in 27 of the top 30 metros in Lifestyle and 15 in the RBN segment. The weakest performance in short-term rent growth was registered in Austin (down 1.2 percent in Lifestyle and 0.7 percent in RBN) and Orlando (down 0.8 percent in Lifestyle and 0.5 percent in RBN).

Renewal rents mirror multifamily asking rents’ performance

Renewal rent growth continued to moderate, up 5.9 percent year-over-year in August, the lowest since September 2021. Typically, the highest renewal rents were posted in markets where asking rents trended up, such as New York (11 percent), Boston (9.2 percent), Indianapolis (8.6 percent), Kansas City (8.5 percent) and New Jersey (7.2 percent). At the other side of the spectrum were San Francisco (-5.0 percent), Phoenix (3.5 percent) and Seattle (4.4 percent)—in these metros asking rents turned negative. Meanwhile, the national lease renewal rate averaged 64.4 percent in August, the highest registered in New Jersey (81.3 percent) and lowest in San Francisco (48.2 percent).

Asking rents for single-family rental declined by another $2 in October, to $2,121, a 1.0 percent year-over-year increase and 30 basis points below the September rate. SFR occupancy inched up 10 basis points year-over-year to 95.9 percent. The recent increases in expenses pushed SFR operators to focus on operational efficiency. According to Yardi Matrix Expert data, total SFR operating expenses rose by 12.2 percent on a trailing 12-month basis through September. Specifically, the average expense per unit rose to $9,149 per unit during the interval. Expense growth was led by marketing (28.1 percent), insurance (23.4 percent) and repairs and maintenance (19.6 percent). Overall, maintenance accounts for 17 percent of total expenses and insurance for about 5 percent.

Read the full Yardi Matrix multifamily real estate report.

The post National Multifamily Report – October 2023 appeared first on Multi-Housing News.

Contact Information

7150 East Camelback Road, Scottsdale, AZ 85251

Email Address: info@fourpalmscapital.com

Phone Number: 484-767-7331

Browse Our Website

About Our Company

All Rights Reserved | Four Palms Capital